Gender pensions gap: gloom and a possible ray

A couple of fairly gloomy charts, I’m afraid, but I find it constantly important to get the message across about how the Paula Principle affects the whole life course. Indeed, its biggest impact is on the second half of people’s lives: first, because the gender earnings gap is greatest for older workers, and secondly because this carries on into life after work. Remember that by now, because of the competence crossover (women surpassing men in qualifications etc) a lot of these women pensioners are better qualified than their male counterparts.

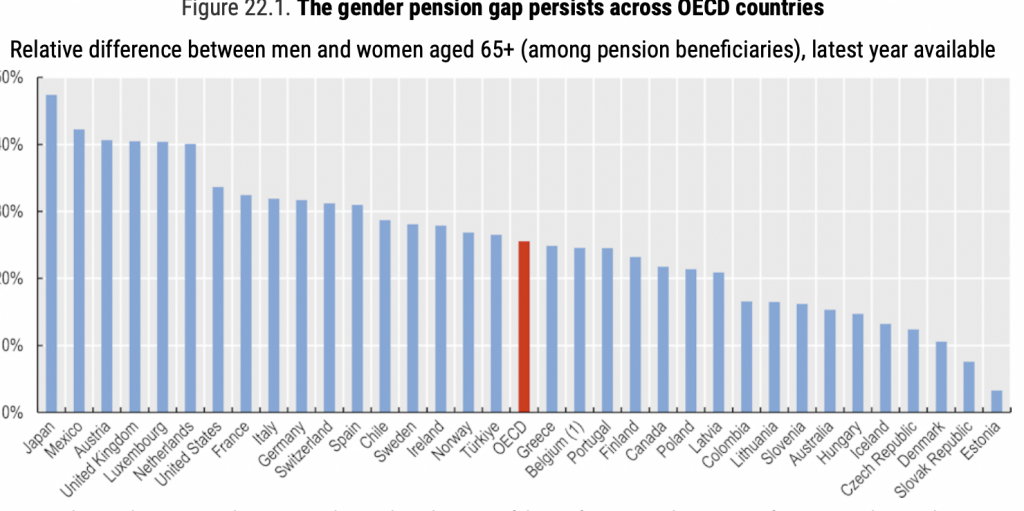

First the international picture, shown in the OECD chart below. My techno-incompetence (lopping off the figures from the vertical axis) gives the impression of some weird equality. Sorry, but you’ll have to put your own scale in – and it should show that the UK’s gap is a shocking 40%. That’s a gap, I need hardly remind you, that will last, almost irrevocably, for decades. And I probably also don’t need to remind you that the UK’s general pension levels are very miserly by international standards. so women get a bum deal off a bum deal.

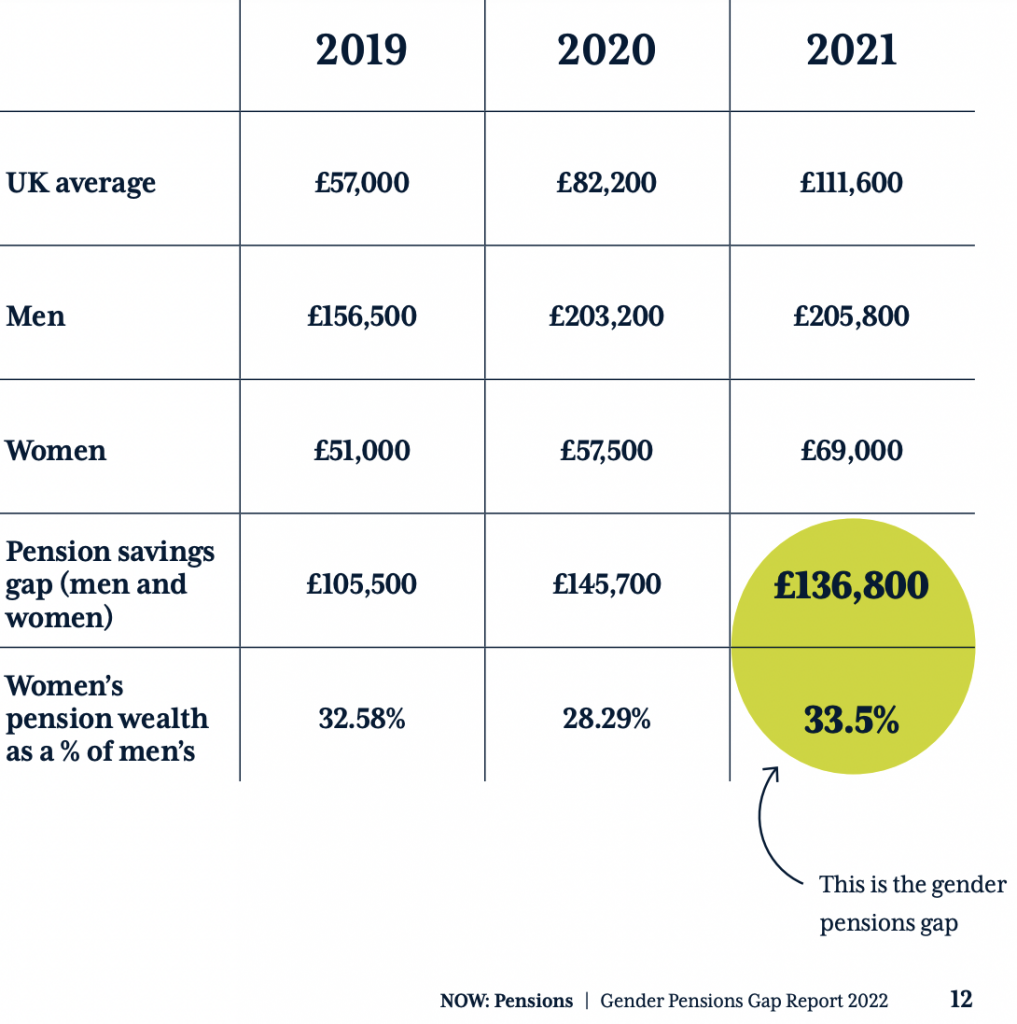

Now let’s turn to some more specific data, from a recent report from NOW Pensions. This deals with pensions savings rather than income. The chart shows that the pensions wealth gap is slightly lower than the pensions income gap, at 33.5%. But it shows that the 2021 gap is actually bigger in % terms than the 2020. This is because both women and men lost pension wealth and men lost more than women, but it’s still an impressive gap.

The blog title mentions a ray. This comes from an FT article (24 June) by Faith Glasgow which refers to an ‘eye-opening’ CEBR finding that by 2025 60% of UK wealth will be in women’s hands. I can’t find the report Faith refers to, and am a bit puzzled at how this can be happening – unless there are a lot of wealthy widows – but it’s a rare picture of reverse inequality.