Finance Curse and Brain Drain

A couple of days ago I took part in a webinar organised by the admirable Transparency Task Force. The TTF promotes reform of our dubiously accountable finance sector. The speaker on this occasion was Nicholas Shaxson. I’d read and enjoyed his exposé of tax havens, Treasure Islands, some years ago. I’d also read and been impressed by his more recent The Finance Curse, which argues that the UK suffers from its overdeveloped finance sector just as other countries have suffered from over-reliance on a natural resource such as oil.

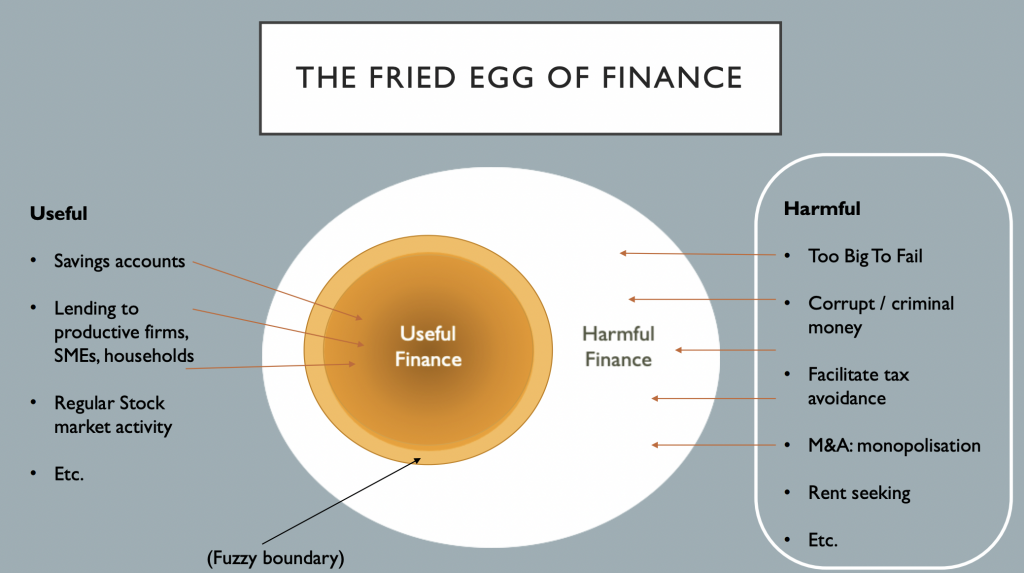

Of course we need banks and financial institutions. They enable businesses to start up and grow, and individuals to use their money safely. We all benefit from their activity – up to a point. But beyond that point the piling up of ever-more frenetic financial dealings distorts our economy and causes all kinds of problems, to individuals and systemically. Nicholas Shaxson’s fried egg diagram below summarises this neatly.

At the webinar I offered an example from some 25 years ago. My mother had a lodger, David, who was completing his PhD in physics. I remember asking him whether he was going on to further research, or possibly working for some interesting scientific enterprise. Slight shamefacedly David said he was heading off to the City – where he could earn 3-4 times as much as anything else on offer. You couldn’t blame him, but that meant 7 years of training, mainly at public expense, now going to what Adair Turner memorably called ‘socially useless’ activity. I’ve always remembered John Kay’s figure, from his book Other People’s Money, where he identifies 3% of financial activity as being linked to the production of actual goods and services that people consume or use; the remaining 97% is internal financial trading, whizzing ‘money’ around within the sector to the profit of the agents concerned but no identifiable wider benefit. We need liquidity, but not vast lakes of financial derivatives

I find Nicholas’ argument compelling and important. How does it relate to the Paula Principle? The answer is that both are concerned with the misuse of competences. In Paula’s case it’s the way women’s skills and qualifications are widely under-recognised and under-valued. In the case of the Finance Curse it’s the way the rewards offered by an inflated finance sector draws in well-qualified people (such as David) who could be putting their competences to better use in other fields. In particular, scientifically qualified people with advanced numeracy skills are, quite understandably, seduced by the salaries and bonuses offered by financial institutions. They put their brains into devising ever more complex financial instruments which primarily benefit only the banks, hedge funds and others who trade in them.

So Nicholas and I are both concerned with how to enable better use to be made of the population’s competences. He has the tougher task. Individual organisations can work – and are working – to challenge the Paula Principle and give due recognition to women’s qualifications and experience. The finance curse is more systemic; it can only be effectively confronted by actions which reform the sector as a whole, and this is a heck of a big ask, with powerful interests aligned against it.

All power to his elbow.